Anchor Tenants: Role in Portfolio Stability

Anchor tenants are the backbone of commercial real estate portfolios. Here's why they matter:

Stability: Anchor tenants like Walmart or Target sign long-term leases (10–25 years), ensuring steady income and lower vacancy risks.

Higher Property Value: Properties with anchor tenants attract more investors, lenders, and smaller tenants, boosting property value and rental income.

Tenant Retention: Anchor tenants drive foot traffic, benefiting smaller businesses and improving lease renewals.

Portfolio Diversification: They create a balanced tenant mix, reducing reliance on any single industry.

Without anchor tenants, properties face:

Higher vacancy risks due to less foot traffic.

Income instability with frequent tenant turnovers.

Lower property values and financing challenges.

Anchor tenants bring stability but come with risks if they leave. A balanced portfolio with both anchor and non-anchor properties can help mitigate risks while maximizing returns.

What Is An Anchor Tenant In Real Estate? - CountyOffice.org

1. Properties With Anchor Tenants

When it comes to maintaining portfolio stability, properties with anchor tenants offer undeniable advantages. These tenants not only occupy significant space but also lend credibility to the property and attract steady foot traffic.

Vacancy Risk

Anchor tenants significantly lower the risk of vacancies by drawing in large numbers of visitors. Well-known brands like Target or Walmart often create a ripple effect, encouraging smaller businesses to set up shop nearby. Their long-term lease agreements - typically spanning 10 to 25 years - ensure consistent rental income [4]. Plus, having a recognizable anchor tenant makes the property more appealing to potential investors and lenders, simplifying financing and attracting additional tenants [7].

Income Stability

Properties with anchor tenants enjoy more stable income streams. These tenants often contribute between 30% and 60% of a property’s total rental income through long-term leases [3]. This steady revenue stream helps properties weather economic downturns and increases their overall market value [4].

Tenant Retention

The increased foot traffic generated by anchor tenants benefits smaller retailers, often leading to improved sales and higher lease renewal rates [1]. Additionally, the presence of a major brand instills confidence in the property’s management, which helps retain tenants across the board.

Portfolio Diversification

Anchor tenants contribute to portfolio diversification by attracting a variety of complementary businesses. This creates a well-rounded mix of tenants, reducing dependence on any single industry. A balanced tenant roster not only reflects strong property management but also appeals to institutional investors looking for consistent returns. As Demetree Global puts it:

“Anchor tenants are crucial for retail success, drawing in customers and boosting credibility for commercial projects.”

Additionally, major anchor tenants can enhance geographic diversification, further stabilizing the portfolio. These benefits highlight the stark contrast between properties with anchor tenants and those without, which often struggle to achieve the same level of stability and appeal.

2. Properties Without Anchor Tenants

When a property lacks anchor tenants, it often faces steeper challenges in occupancy, income stability, and tenant retention. This section dives into how the absence of these key tenants can amplify these hurdles.

Vacancy Risk

Properties without anchor tenants are at a much higher risk of vacancies. Anchor tenants naturally draw in foot traffic, which benefits smaller retailers by increasing their exposure to potential customers. Without this pull, smaller businesses may struggle to attract enough customers to justify their lease costs, especially during economic downturns.

Data shows that high-performing anchor tenants can boost foot traffic by 20–40% [9]. Properties without these anchors miss out on this advantage, and the issue is further exacerbated by the current retail climate. Nearly 10,000 store closures are expected, while fewer than 8,000 new stores are projected to open [10]. This imbalance makes filling vacant spaces even more difficult.

Income Stability

Revenue stability becomes a significant challenge for properties without anchor tenants. Rental rates can drop by as much as 25% [11], and frequent tenant turnover adds to costs, requiring additional spending on marketing and property improvements [12]. For properties that have never had an anchor tenant, achieving competitive rental rates is an uphill battle from the start.

Tenant Retention

Tenant retention is another uphill battle without the draw of anchor tenants. Smaller retailers often experience lower sales, which makes lease renewals less likely. This leads to higher turnover costs, with tenant turnover averaging $2,500 per vacancy, alongside marketing expenses that range from $50 to several hundred dollars per listing [13].

To retain tenants in non-anchor properties, landlords need to focus on proactive maintenance, fair and consistent rental pricing, and excellent customer service [13]. Building strong relationships through clear communication becomes even more critical when tenants cannot rely on anchor-driven foot traffic.

Terry Richardson, CEO of Heritage Partners, highlights the resilience of small tenants:

“Every one of our 125 mom-and-pop tenants paid in full after recovering from mandated government closures. When your business puts food on the table, you find a way.”

Portfolio Diversification

While having multiple smaller tenants can diversify income, it also increases management complexity. Properties without anchor tenants face all-or-nothing risks, especially if several leases expire at the same time [12]. Success in managing this complexity requires strategic tenant selection, focusing on reliable businesses that cater to specific markets, and staggering lease end dates to avoid mass vacancies [12].

Additionally, properties with anchor tenants generally command higher market values, making them more appealing to investors [4]. In contrast, non-anchor properties often face challenges in securing financing and attracting investor interest.

In response to these challenges, developers are increasingly turning to mixed-use developments and incorporating green spaces to attract niche tenants or alternative anchor options [2].

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Advantages and Disadvantages

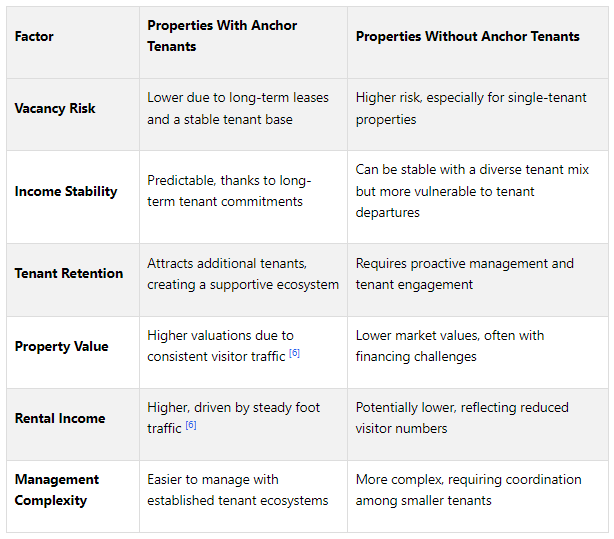

Choosing between properties with or without anchor tenants involves weighing distinct benefits and challenges. Each option shapes investment returns and risk profiles differently, making it essential to understand the trade-offs before making portfolio decisions. Below is a comparison of key factors:

A Closer Look at Anchor Tenant Properties

Properties with anchor tenants often deliver stability. These tenants sign long-term leases, ensuring consistent cash flow and lower vacancy concerns [6]. Their presence tends to attract additional tenants and visitors, boosting property value and rental income. For investors, this translates to more predictable returns and reduced risk.

However, relying on a single anchor tenant comes with its own set of challenges. If the anchor tenant vacates, re-tenanting large spaces can take 12–24 months [5]. Additionally, anchor tenants often negotiate favorable lease terms, which can limit a property owner's ability to raise rents and may constrain income growth [14].

Insights on Non-Anchor Tenant Properties

Properties without anchor tenants face higher vacancy rates and income volatility. Managing a mix of smaller tenants can also be more demanding. That said, they offer flexibility. Owners can adjust tenant selection and lease terms more easily, allowing them to respond quickly to market changes. This adaptability can be an advantage in dynamic markets but comes with increased risks of tenant turnover and operational complexity.

Portfolio Diversification and Risk

When it comes to portfolio management, these two property types offer different approaches to diversification. Anchor-tenant properties provide stability but concentrate risk in a few large tenants. On the other hand, non-anchor properties distribute risk across multiple smaller tenants, though this can lead to higher collective vacancies if leases expire simultaneously.

Anchor tenants also enhance financing opportunities and attract investors, while non-anchor properties may face challenges in securing financing or achieving favorable exit strategies.

Conclusion

Deciding between properties with anchor tenants and those without plays a critical role in shaping portfolio stability and returns. Anchor-tenant properties offer steady cash flow thanks to long-term leases and attract consistent foot traffic, making them appealing to investors who prioritize stability. This trend is particularly noticeable in the retail sector [15].

That said, relying on anchor tenants comes with its own risks. Nate Nead, Managing Partner at InvestNet, LLC and HOLD.co, puts it succinctly:

“Anchors can absolutely act as stabilizers - much like a blue‑chip stock in a diversified portfolio. Yet over‑relying on their presence is the real risk.”

On the other hand, non-anchor properties provide a different investment profile. These properties spread risk across multiple tenants, often feature lower operating costs through Triple Net leases, and offer more flexibility with shorter lease terms ranging from 5 to 20 years [16].

As highlighted earlier, a balanced strategy that combines both property types can mitigate risks effectively. Savvy investors often diversify their portfolios to harness the stability of anchor-tenant properties while benefiting from the adaptability and risk distribution of non-anchor investments. Achieving this balance requires thorough due diligence - evaluating tenant creditworthiness, reviewing lease agreements, and modeling scenarios to prepare for potential anchor vacancies or market shifts.

For those navigating these decisions, The Fractional Analyst's underwriting services and financial modeling tools offer the in-depth analysis needed. By assessing tenant strength, lease structures, and long-term performance, these tools empower investors to make well-informed choices that safeguard portfolio stability and foster growth.

FAQs

-

Anchor tenants are a key factor in boosting the financial and investment appeal of commercial properties. Their long-term leases ensure a steady stream of income, which minimizes vacancy risks and provides a sense of stability for property owners. This dependable revenue often makes these properties more appealing to lenders, who may offer more favorable financing terms as a result.

Beyond financial stability, anchor tenants also enhance the property's reputation. They attract more visitors, increasing foot traffic and making the location more desirable in the market. For investors, this combination of reliability and increased visibility makes properties with anchor tenants a safer and more attractive choice, particularly during uncertain market periods.

-

Relying too much on anchor tenants can bring several challenges to a real estate portfolio. When an anchor tenant moves out, it often causes a noticeable drop in rental income. Worse, it might trigger a chain reaction where smaller tenants lose confidence and decide to leave as well. This can lead to higher vacancy rates and make the property less stable overall.

Another issue is the risk tied to the financial health of anchor tenants. If one of these key tenants struggles financially, reduces their operations, or decides to relocate, it could harm the property's value and long-term earnings. A smart way to reduce these risks is to diversify the tenant mix by including businesses from different industries. This approach can provide greater stability and make the portfolio more resilient.

-

A portfolio that includes a mix of anchor tenants and non-anchor properties strikes a smart balance between stability and growth. Anchor tenants - think big-name retailers or large corporations - usually come with long-term leases and dependable cash flow, offering a solid financial backbone for your investments.

Meanwhile, non-anchor properties add variety to your income streams, reducing dependence on any single tenant or property type. This diversification acts as a buffer against market swings, vacancy risks, and economic slowdowns, while also opening doors for potentially higher returns. Combined, this approach supports steadier performance and sets the stage for sustainable growth over time.