How Promote Structures Align GP/LP Interests

Promote structures in commercial real estate ensure that General Partners (GPs) and Limited Partners (LPs) share profits fairly while incentivizing GPs to achieve strong investment performance. Here's what you need to know:

Preferred Returns: LPs receive a set return (usually 6%-10%) before GPs share profits.

Performance-Based Rewards: GPs earn carried interest only after surpassing specific return hurdles.

Waterfall Models: Profits are distributed in tiers, with higher GP rewards for better performance.

Risk Sharing: LPs are prioritized, ensuring their capital is returned first.

For example, in a typical structure:

LPs receive an 8% preferred return.

Remaining profits might split 70% to LPs and 30% to GPs after performance thresholds are met.

Promote structures align interests by tying GP compensation to results, balancing risks, and fostering collaboration between GPs and LPs.

A Beginner's Guide To Real Estate Equity Waterfalls

Key Components of Promote Structures

Promote structures revolve around four key elements: preferred return hurdles, equity splits, waterfalls, and carried interest. Together, these components balance risk and reward, creating a system that aligns the interests of General Partners (GPs) and Limited Partners (LPs).

Preferred Return Hurdles

Preferred return hurdles prioritize LPs, ensuring they receive a set return on their investment before GPs share in the profits. These returns typically range between 6% and 8%, with 8% and 10% hurdles appearing in 40% and 30% of projects, respectively. The hurdle acts as a benchmark that must be met before profit-sharing begins.

Unlike traditional bank returns, preferred returns in real estate can be structured in two ways: current pay (distributed during the investment period) or accrued (paid later, often at sale or refinancing). This flexibility allows sponsors to reinvest cash flow into property improvements while still respecting LPs' priority claims.

Equity Splits and Waterfalls

Once the preferred return hurdle is cleared, the waterfall structure dictates how remaining profits are divided between GPs and LPs. Waterfalls often include multiple tiers, rewarding GPs more generously as performance improves. Around 75% of projects use two equity splits, and 85% base their breakpoints on the Internal Rate of Return (IRR).

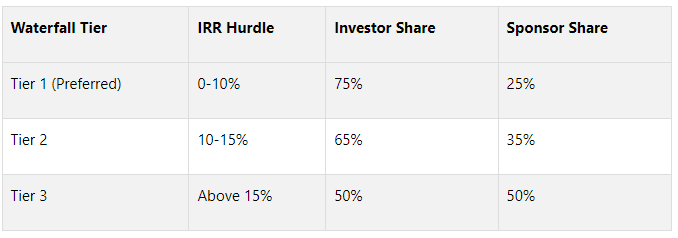

Here’s an example of a typical multi-tier waterfall structure:

This setup ensures LPs maintain priority in lower-performing scenarios while GPs are rewarded more significantly for achieving higher returns.

Carried Interest as GP Incentives

Carried interest serves as a performance-based reward for GPs, typically ranging from 20% to 30% of profits above the hurdle rates. This incentive is calculated only after debt repayment and preferred returns are satisfied, ensuring GPs earn their share only after fulfilling their obligations to investors.

For instance, consider a GP who purchased an apartment building for $10 million in 2019, fully funded by LPs. With a 10% annual hurdle and 30% carried interest, the building’s 2024 sale at $18 million resulted in $5 million in preferred returns to the LPs. The remaining $3 million was split, with $2.1 million (70%) going to the LPs and $900,000 (30%) to the GP.

This structure ensures GPs are rewarded for exceptional performance, but only after meeting their commitments to LPs, fostering a balanced and aligned partnership.

How Promote Structures Align GP and LP Interests

Promote structures are designed to align the goals of General Partners (GPs) and Limited Partners (LPs) by linking GP compensation directly to how well an investment performs. This setup encourages GPs to exceed performance benchmarks, ensures risks are shared fairly, and clarifies the roles of each partner.

Performance-Based Incentives

Promote structures reward GPs only when investment performance surpasses specific targets. For instance, GPs earn their promote after LPs receive their preferred returns. Let’s take a real estate investment generating a 16% annual return with an 8% preferred return hurdle. In this case, LPs first receive their full 8% preferred return, and the remaining 8% in profits is then split - commonly 70% to LPs and 30% to the GP. This structure motivates GPs to push for higher returns since their compensation grows alongside the investment's success.

Balancing Risk and Reward

By design, promote structures create a fair system for sharing both risks and rewards. LPs are prioritized in the “waterfall” distribution, ensuring their capital is returned before profits are divided. Hurdle rates serve as performance thresholds, requiring investments to hit certain return levels before GPs can claim their share of the profits.

Complementary Roles and Benefits

This shared framework acknowledges the unique contributions of both parties. LPs provide the capital, while GPs bring expertise in managing assets and making strategic decisions. Since GP compensation is tied to performance, they are incentivized to manage investments effectively. Waterfall structures further encourage GPs by offering larger profit shares when financial goals are exceeded. Preferred return rates, often between 8% and 10%, ensure LPs are fairly compensated for their investment before GPs share in the upside.

When structured well, promote agreements do more than just align financial incentives - they also encourage open communication and shared objectives, increasing the likelihood of a successful outcome.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Best Practices for Designing Promote Structures

Creating effective promote structures requires careful documentation, financial safeguards, and detailed analysis to clearly define roles and ensure equitable returns.

Clear Documentation of Terms

The Limited Partnership Agreement (LPA) is the cornerstone of any promote structure. This agreement should clearly outline key elements such as roles, capital contributions, profit sharing, decision-making processes, fees, and reporting requirements. It must also address how distributions will be timed, how calculations will be performed, and what actions will be taken if performance targets are not met. Involving legal professionals is crucial to ensure the agreement protects all parties while addressing tax and liability considerations.

Adding Preferred Equity and Lookbacks

Once the agreement terms are established, integrating financial safeguards can further align the interests of all parties involved.

Preferred equity provides certain investors with priority access to profits until they achieve a predetermined return. Lookback provisions strengthen this alignment by requiring sponsors to return profits if preferred investors do not meet their return hurdle by the deal's end. Unlike catch-up clauses, which allow investors to claim 100% of profits until their required return is reached, lookback provisions adjust distributions at the deal’s conclusion to ensure the preferred return is achieved. These mechanisms promote fairness and mutual success.

Using Financial Models for Comparisons

Real estate financial models play a critical role in analyzing and comparing promote structures, helping to align them with investment objectives. These models assess returns, risks, and feasibility. Incorporating tailored waterfalls that reflect unique contribution and distribution arrangements is essential. Accurate assumptions and sensitivity analyses are key to understanding how shifts in factors might influence outcomes. Regularly updating these models and collaborating with stakeholders ensures they remain relevant in changing market conditions.

For modeling waterfalls with irregular cash flow dates, XIRR is often preferred over standard IRR.

The Fractional Analyst offers specialized financial models designed to simplify the evaluation of promote structures. These models not only allocate profits accurately but also provide a foundation for ongoing performance monitoring.

Monitoring and Adjusting Promote Structures Over Time

Promote structures need ongoing attention and fine-tuning to stay in sync with the goals of General Partners (GPs) and Limited Partners (LPs). This process involves keeping a close eye on performance metrics and adapting to changing market conditions.

Tracking Performance and Payouts

Real estate firms rely on specialized systems and AI-driven analytics to monitor key metrics like Net Operating Income (NOI), Internal Rate of Return (IRR), Cash-on-Cash Return, and Equity Multiple. These tools provide a clear picture of an investment’s performance. In many waterfall structures, IRR often serves as the primary benchmark. A common example includes an 8% preferred return paired with a profit-sharing split, such as 90-10 or 80-20, between investors and developers.

Adapting to Market Changes

Regular reviews are critical for adjusting promote structures as the market evolves. For instance, in the early stages of an economic cycle, projects with higher return potential - like a 30% IRR - might lead sponsors to incorporate preferred equity with interest rates of 12%–13%, without including profit-sharing. However, during later stages of the cycle, when returns are closer to 17% at the project level (around 14% IRR for investors), a 12% preferred equity structure may lose its appeal. In these cases, experienced sponsors may opt for a 50-50 split of common equity cash flow after investors achieve a 16% IRR or higher. To ensure effectiveness, sponsors should regularly reassess key metrics, run stress tests, and consider adjustments to preferred return rates, equity splits, or waterfall tiers in response to regulatory changes, shifting investor priorities, or market trends.

Role of Financial Analysis Tools

Advanced financial tools play a vital role in refining promote structures. Detailed spreadsheets allow for thorough deal evaluations by factoring in variables like acquisition costs, operating expenses, financing terms, and rental income potential. Market research platforms provide insights into local trends and property values, while risk assessment tools highlight potential challenges. Mobile apps also enable sponsors to access critical deal metrics on the go.

For example, The Fractional Analyst's CoreCast platform offers tailored financial models and analytics supported by dedicated analysts. With features like real-time performance tracking, scenario modeling, and waterfall distribution analysis, this platform helps sponsors evaluate promote scenarios and their impact on GP and LP returns. These tools ensure promote structures remain aligned with investment goals, even as market conditions shift.

Conclusion: The Importance of Effective Promote Structures

Effective promote structures are at the heart of successful commercial real estate partnerships, ensuring that General Partner (GP) and Limited Partner (LP) rewards are closely tied to performance and shared risk.

Key Takeaways

Promote structures bring several important benefits to commercial real estate investments:

Incentive Alignment: GPs earn rewards only when they exceed preferred return thresholds, encouraging stronger performance.

Risk Sharing: A well-balanced structure prioritizes LP returns while fairly compensating GPs for taking on entrepreneurial risks .

Performance Optimization: By tying promote payouts to financial benchmarks, sponsors are driven to maximize asset performance. This creates a scenario where investors benefit from strong preferred returns, while sponsors are incentivized to deliver exceptional results. Commonly, remaining profits are split 70% to LPs and 30% to GPs, though these ratios can vary depending on the deal.

These benefits underscore the importance of detailed financial analysis in structuring and managing promotes.

Leveraging Financial Expertise

The complexity of promote structures requires advanced financial analysis and continuous oversight. Professionals rely on specialized tools to design, evaluate, and adjust these arrangements as conditions change.

Strategic planning involves assessing current performance, setting achievable goals, and forecasting financial outcomes. This process informs budgeting decisions, property improvements, and risk management using models that account for factors like market shifts, interest rates, and vacancy rates. Techniques such as discounted cash flow (DCF) and net present value (NPV) analysis are essential for evaluating promote scenarios, while ongoing monitoring ensures adherence to tax and reporting standards.

Tools like the Fractional Analyst’s CoreCast platform simplify these challenges by offering tailored financial models and analytics. With features like real-time performance tracking, scenario modeling, and waterfall distribution analysis, the platform helps sponsors assess promote structures and their impact on GP and LP returns. This level of financial expertise ensures promote structures remain aligned with overall investment goals, even as market dynamics shift.

FAQs

-

Promote structures are built to align the goals of General Partners (GPs) and Limited Partners (LPs) by linking compensation directly to how well investments perform. Essentially, GPs receive a larger portion of the profits - known as the promote - but only after hitting certain performance targets, such as a preferred return or a specific internal rate of return (IRR).

This setup motivates GPs to focus on maximizing returns while ensuring LPs' initial investments are safeguarded. By rewarding GPs for surpassing these benchmarks, promote structures create a partnership where both sides share in the success of profitable investments.

-

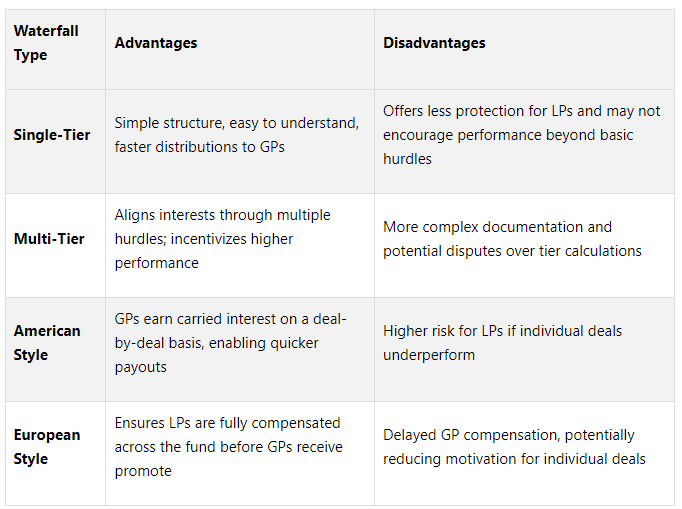

Multi-tier waterfall structures in promote models bring several advantages compared to single-tier setups. By incorporating multiple performance benchmarks, they allow for more precise profit distribution, balancing the risk and reward between general partners (GPs) and limited partners (LPs). This layered approach also motivates GPs to aim for higher returns, as their compensation is tied to achieving specific performance milestones.

These models also offer added flexibility, which is especially beneficial for complex real estate transactions. For instance, they can reward GPs earlier in the investment process while ensuring LPs receive their preferred returns first. This structure aligns the interests of all parties involved, fostering trust and collaboration - key elements for building equitable, performance-focused partnerships in commercial real estate.

-

Promote structures can evolve with shifting market conditions by integrating flexible profit-sharing models and adjustable hurdle rates. These features ensure that both General Partners (GPs) and Limited Partners (LPs) remain motivated, even during unpredictable market periods.

For instance, profit-sharing arrangements can be linked to specific performance benchmarks, ensuring returns are distributed fairly based on actual market results. Regularly revisiting and updating partnership agreements to align with current market realities also strengthens trust and fosters long-term alignment between GPs and LPs. This proactive approach helps preserve collaboration and achieve balanced returns for everyone involved.