12 CFR Standards: Impact on CRE Exit Strategies

12 CFR standards are federal regulations that shape how banks handle commercial real estate (CRE) loans. These rules affect critical aspects of exit strategies, such as refinancing, selling, or restructuring. Here's what you need to know:

Loan-to-Value (LTV) Limits: Strict LTV caps (e.g., 85% for improved properties) can limit refinancing options and push property owners toward sales or partnerships.

Portfolio Diversification: Banks must balance loan exposure across property types and regions, which can restrict financing for certain projects.

Market Monitoring: Lenders adjust policies based on real estate trends, impacting financing availability during market shifts.

Concentration Limits: High CRE loan concentrations can make banks more selective, complicating exit plans.

Compliance Requirements: Strict documentation rules can delay transactions, especially for loans exceeding LTV limits.

Quick Tip: Tools like The Fractional Analyst help property owners align their strategies with 12 CFR rules by offering financial modeling, market insights, and compliance-focused reports. This can streamline exit planning and improve financing outcomes.

Takeaway: Understanding 12 CFR standards is essential for CRE professionals. Combining these regulations with tools like The Fractional Analyst can help navigate challenges and optimize exit strategies.

Jim Dowd of North Capital explains why private market risk is more correlated than it appears

1. 12 CFR Standards

The 12 CFR Part 365 regulations lay the groundwork for how FDIC-supervised institutions manage real estate lending, which directly impacts commercial real estate (CRE) exit strategies. These rules require financial institutions to have written policies that define clear limits and standards for loans secured by real estate assets. The regulations touch on key areas like collateral limits, portfolio management, market responsiveness, and documentation. Together, these elements shape how institutions handle refinancing, diversify portfolios, and respond to changing market conditions.

Loan-to-Value Limits and Exit Planning

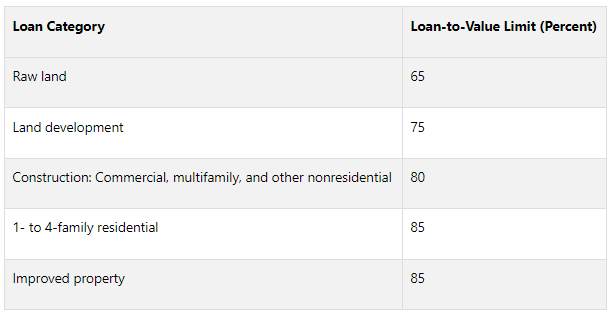

One of the most critical aspects of 12 CFR standards is the supervisory loan-to-value (LTV) limits, which vary depending on the type of property. These limits significantly influence refinancing options during exit planning:

For example, an improved property can only secure up to 85% of its value under traditional lending limits. Properties with loans exceeding these thresholds may face challenges in refinancing, often leading owners to consider alternatives like outright sales or joint ventures as part of their exit strategy.

Portfolio Diversification Requirements

In addition to collateral limits, portfolio diversification rules further shape exit strategies. Banks are required to set diversification standards for their loan portfolios. This means they must carefully balance their exposure across various property types and geographic areas. As a result, even highly qualified borrowers may find financing options limited if their project doesn’t align with a lender’s diversification goals. These constraints can influence the timing and structure of exit plans.

Market Monitoring and Adaptive Lending Policies

Federal regulations also require institutions to closely monitor real estate market trends and adjust their lending policies accordingly. This dynamic approach directly impacts how exit strategies unfold. For instance, properties with strong cash flow and operational performance are more likely to secure refinancing, while those relying primarily on appreciation may face stricter lending criteria. These shifting standards can create challenges for property owners looking to refinance or reposition their assets in the market.

Concentration Limits and Their Influence

The framework also addresses concentration levels of commercial real estate loans within bank portfolios. When banks approach their concentration limits, they often become more selective in their lending practices. This can force property owners to explore alternative exit strategies or accept less favorable terms for financing.

Compliance and Documentation Challenges

Finally, the procedural requirements under 12 CFR standards add complexity to exit transactions. Institutions must adhere to strict documentation and reporting rules, which can extend transaction timelines and increase costs. For example, loans exceeding supervisory LTV limits must be reported to the board of directors, and properties seeking financing beyond these limits require enhanced due diligence. This process often involves demonstrating exceptional creditworthiness or providing additional collateral, which can delay financing and complicate exit plans. While exceptions to general lending policies are possible for creditworthy borrowers, they require additional approvals, further slowing down transactions.

2. The Fractional Analyst

The Fractional Analyst takes the guesswork out of navigating 12 CFR compliance, offering targeted financial analysis and planning tailored for commercial real estate professionals. With strict lending standards shaping exit strategies, this service focuses on helping property owners overcome regulatory hurdles. By combining advanced financial modeling with market insights, it provides the tools needed for smoother and more successful property transactions.

Compliance-Focused Financial Analysis

One of the standout features is its underwriting services, which allow property owners to assess their assets against 12 CFR lending requirements before engaging with lenders. This proactive approach means investors can spot potential financing challenges early in their planning. The team also runs detailed scenario models to evaluate financing options at different leverage levels, ensuring refinancing and exit strategies are timed for maximum benefit.

Market Research and Strategic Planning

Understanding the interplay between market trends and regulatory constraints is critical for planning a successful exit. The Fractional Analyst leverages high-quality data to monitor market dynamics, keeping clients updated as lending policies shift in response to regulations. Additionally, their research dives into local market conditions and lender preferences, helping property owners connect with financial institutions that align with their needs.

Investor and Lender Communication

Armed with data-driven insights, the Fractional Analyst creates detailed reports that meet the documentation demands of 12 CFR. These reports clearly outline project financials, making it easier to gain approval for complex transactions. For property owners looking to present their exit strategies effectively, the platform also offers pitch deck creation services. These decks emphasize operational strengths and financial stability, ensuring a compelling case for investors and lenders.

Flexible Service Model

The Fractional Analyst is designed to be both effective and accessible. Subscriptions start at $300 per user per month, providing access to advanced financial tools without the need for a full-time staff. Free downloadable resources, including financial models, allow professionals to perform initial evaluations on their own. For more in-depth needs, the CoreCast intelligence platform offers two options: hands-on support from financial analysts or self-service tools for routine tasks. This flexibility ensures that clients get exactly the level of assistance they require for compliance and strategic planning.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Advantages and Disadvantages

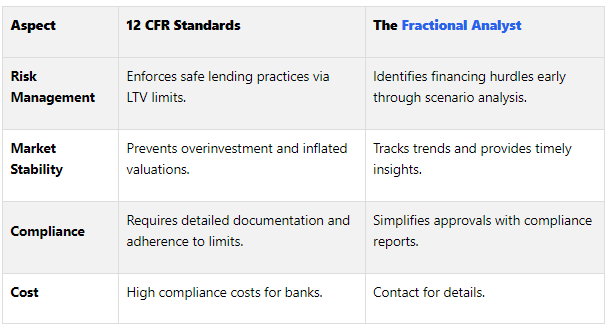

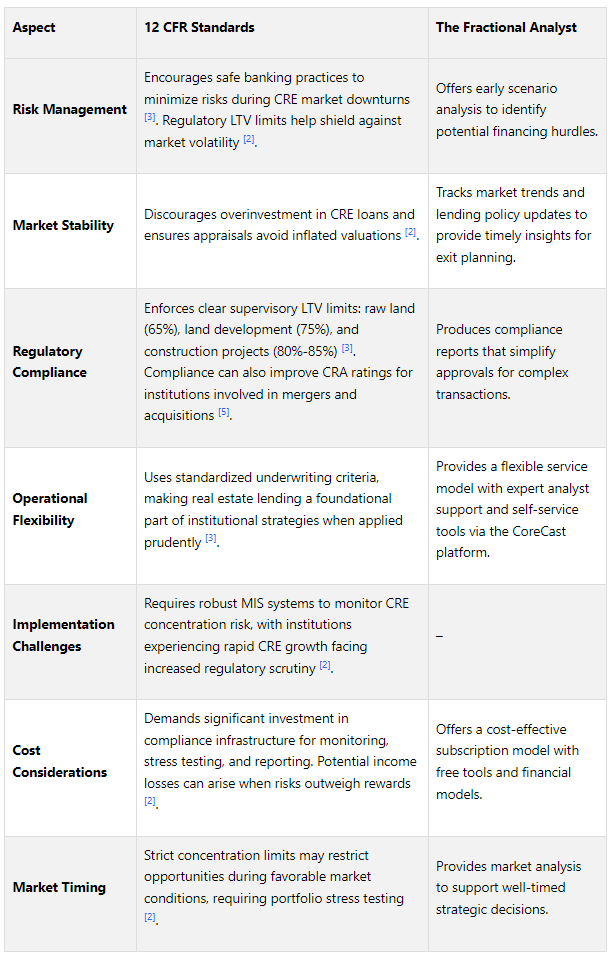

When it comes to navigating CRE exit strategies, understanding the nuances of 12 CFR standards and The Fractional Analyst's methods can make a world of difference. Each approach has its own strengths and limitations, particularly in how they influence timing, costs, and outcomes.

Here’s a side-by-side look at some key aspects:

While 12 CFR standards provide a stable framework, they can limit flexibility during favorable market conditions. For instance, adhering to strict LTV limits may leave institutions vulnerable during CRE downturns. This rigidity often frustrates property owners, particularly those managing development projects or properties in transitional markets, as traditional lending approaches can feel restrictive during exit planning.

On the other hand, The Fractional Analyst complements these standards, creating more opportunities for strategic exits within regulatory limits. However, its success hinges on access to reliable market data and the user's ability to interpret complex financial models. High CRE exposures can complicate the process, leading to longer approval times and more conservative lending practices.

Ultimately, the choice between relying solely on regulatory frameworks or incorporating specialized analytical tools depends on the specifics of the exit strategy, current market conditions, and the institution's appetite for risk. For properties requiring creative financing or operating in unpredictable markets, enhanced analytical tools can be a game-changer. Conversely, straightforward transactions may proceed smoothly within the scope of traditional regulatory frameworks. By weaving these insights into your exit strategy, you can navigate even the most complex market conditions with greater confidence.

Conclusion

The 12 CFR standards establish a regulatory framework that demands strict adherence and careful planning for commercial real estate (CRE) exits. These federal rules significantly influence how financial institutions handle CRE lending, shaping the availability and terms of exit financing for property owners and investors.

For instance, the capital adequacy requirements outlined in 12 CFR Parts 3 and 217 mandate that banks maintain capital reserves proportional to the risk associated with CRE investments. As stated, "This part establishes minimum capital requirements and overall capital adequacy standards for national banks and Federal savings associations". This reliance on risk-based capital introduces an element of unpredictability into exit financing strategies.

Regulators also hold the authority to require banks to adjust their capital reserves or assign different risk-weighted asset values if they believe the calculated requirements don’t align with actual exposure risks. This flexibility allows for adjustments based on evolving risk assessments but adds another layer of uncertainty for CRE professionals planning their exits.

To navigate these challenges, a tailored approach is essential. Tools like The Fractional Analyst provide advanced modeling and dual-service capabilities that help CRE professionals align their strategies with both 12 CFR requirements and market conditions. Features such as stress testing and market analysis are particularly useful when banks need to show that their CRE portfolios comply with regulatory expectations.

The advantages extend beyond mere compliance. Using financial modeling and regulatory insights, CRE professionals can design exit strategies that not only meet capital requirements but also optimize returns. This is especially important as regulators expect banks to adapt their risk management practices to align with changing market conditions and their unique risk profiles.

Ultimately, successful CRE exits require a deep understanding of both regulatory frameworks and market trends. By combining compliance with robust analysis, professionals can uncover strategic opportunities and navigate the complexities of the 12 CFR landscape.

FAQs

-

The 12 CFR real estate lending standards are key in determining how refinancing works for commercial real estate. These regulations set the rules for property valuation, risk assessment, and lending practices, all of which directly impact the terms and approval process for refinancing.

For borrowers, this means lenders follow strict guidelines when assessing loan applications. They look at factors like the property's value, current market conditions, and the borrower's financial health. Knowing how these standards work is essential for crafting refinancing strategies that meet both regulatory demands and market expectations.

-

Diversifying a portfolio plays a crucial role in crafting exit strategies under 12 CFR real estate lending standards. These regulations impose limits on loan concentrations based on property types and geographic regions, enabling financial institutions to better manage risk. By spreading their investments across different markets and asset classes, lenders can reduce their vulnerability to specific market fluctuations while staying compliant with regulatory guidelines.

This strategy not only promotes sound underwriting practices but also gives institutions the flexibility to respond to market shifts and evolving regulations. A thoughtfully diversified portfolio helps minimize risks and improves the chances of achieving favorable outcomes when navigating exit strategies in commercial real estate.

-

The Fractional Analyst provides property owners with the guidance they need to stay compliant with 12 CFR real estate lending standards. Their services are customized to each client and include underwriting support, in-depth market research, and financial modeling. These offerings are designed to help clients meet federal regulations while minimizing potential risks.

With The Fractional Analyst’s tools and expertise, property owners can simplify their planning processes, make smarter decisions, and confidently craft exit strategies that align with regulatory guidelines.