How to Value Ground Leases Using Capitalization Rates

Ground leases are long-term agreements where tenants lease land to develop it, often lasting 30-99 years. Valuing these leases accurately is essential for investors and landowners, as they provide a consistent income stream and access to prime locations without the high cost of land acquisition. The primary method for valuation is the direct capitalization approach, which uses a capitalization rate (cap rate) to estimate the property's value. Here's a quick breakdown:

Cap Rate Formula: Annual Net Ground Rent ÷ Cap Rate = Property Value.

Cap Rates for Ground Leases: Typically range from 3% to 6%, lower than traditional property investments due to their steady cash flow and lower risk.

Key Factors Affecting Cap Rates: Location, tenant quality, lease terms (e.g., length, escalation clauses), and market conditions.

For example, if annual net rent is $125,000 and the cap rate is 4.5%, the property value is $2.78 million. Adjustments may be needed for lease-specific terms like escalations or shorter durations. Alternative methods like discounted cash flow (DCF) analysis or sales comparisons are also used for more complex scenarios.

Key Takeaway: The direct capitalization method is a straightforward way to value ground leases, but accurate cap rate selection and adjustments for lease features are critical for reliable results.

Ground Lease Valuation Model in Excel - How to Use

How Cap Rates Work for Ground Leases

To grasp how cap rates operate in ground lease valuations, it’s important to go beyond basic math. These rates provide a window into market trends, risk evaluations, and investor expectations in the commercial real estate world. With this foundation, we can dive deeper into the factors that influence risk and market dynamics.

How Cap Rates Reflect Market and Risk Factors

Cap rates for ground leases behave differently compared to traditional real estate due to their unique risk profiles and location advantages. Location is a major factor - prime spots typically have lower cap rates because they carry less risk and attract more demand.

Market activity also plays a role. In regions with bustling industrial land transactions and heightened institutional interest, cap rates tend to tighten. Randy Blankstein, president of The Boulder Group, explained it well:

“At a time when cap rates are moving up, ground leases have hung in better than the overall sector, especially the more in‑demand ones.”

The quality of tenants is another key piece of the puzzle. Ground leases with AAA-rated tenants under long-term agreements can see cap rates compressed by as much as 100 basis points when compared to leases with lower-rated tenants. Additionally, the structure of the lease matters. Ground leases that include indexed escalations - typically 5% to 8% every three years - are particularly appealing to investors because they offer some protection against inflation.

Finding the Right Cap Rate for Ground Leases

Pinpointing the right cap rate requires examining a range of data and market signals. Comparable transaction analysis is a common starting point. For instance, ground leases tied to fast-food brands often trade at cap rates around 4.5%. Timing also plays a role, as shifts in interest rates and market conditions influence the returns investors expect.

The length of the lease term is another crucial factor. Ground leases with 30 to 60 years remaining on the term generally attract lower cap rates because the long-term income reduces reinvestment risk. A broader risk assessment is equally important, considering factors like local economic conditions, potential tenant turnover, and maintenance responsibilities. Properties in secondary or tertiary markets often carry higher cap rates due to added risks.

Interest rates themselves are a direct driver. As rates rise, cap rates often follow, and the reverse is also true. Between 2017 and 2024, the implied cap rates for ground leases averaged a spread of 261 basis points over thirty-year US TIPS, underscoring their link to risk-free rates. These shifts in cap rates have a direct impact on property values, which we’ll explore next.

Cap Rates and Property Value Relationship

Cap rates and property values have an inverse relationship: higher cap rates mean lower property values, and vice versa. This connection is significant because even small changes in cap rates can lead to large swings in valuation. For example, with a 4% cap rate, $100,000 in annual income suggests a property value of about $2.5 million. If the cap rate rises to 5%, the value drops to roughly $2 million.

Growth assumptions amplify this effect. Cap rates represent both expected returns and income growth. Ground leases, known for their steady cash flows, often have lower cap rates. They behave similarly to long-term bonds, offering predictable income streams. Typically, ground leases fall within a cap rate range of 3.65% to 5%, depending on factors like location, asset type, age, percentage of total value, and coverage. Their regular, secure, long-term rental payments often lead to comparisons with fixed-income investments. In some cases, they are even seen as having AAA credit risk, which adds to their attractiveness.

Understanding these cap rate dynamics is critical for accurately valuing ground leases and making well-informed investment decisions. This sets the stage for the detailed valuation process that follows.

Step-by-Step Valuation Process

Now that we've covered cap rates, let’s dive into the step-by-step process for valuing ground leases. This method uses the direct capitalization approach, which offers a clear framework where every step plays a key role.

Calculate Ground Rent Income

The first step in valuing a ground lease is figuring out the net annual ground rent income. This is the annual rent after subtracting operating expenses. Operating expenses for ground leases typically include property taxes, insurance, depreciation, and minimal maintenance costs. For example, if the annual rent is $150,000 and expenses total $25,000, the resulting net income is $125,000.

Property taxes often make up the largest portion of expenses, especially in high-value areas, while insurance costs are relatively low since the ground lessor doesn’t insure the structures on the land. Maintenance costs are minimal, limited to basic land upkeep. These low expenses make ground leases particularly appealing. Once the net income is calculated, the next step is selecting a cap rate that aligns with the investment's risk profile.

Choose the Right Cap Rate

Selecting the right cap rate involves considering factors like property type, location, lease terms, market conditions, and tenant quality. A higher cap rate reflects a higher-risk investment, which may offer greater returns but with more volatility. On the other hand, a lower cap rate suggests lower risk and more stable cash flows.

To determine an appropriate cap rate, research comparable transactions and evaluate factors like lease terms and tenant quality. Typical cap rates for ground leases range between 3% and 6%. Pay close attention to the lease agreement, especially escalation clauses, as these can significantly impact value. Longer lease terms tend to reduce risk and support lower cap rates, while shorter terms can increase risk.

Randy Blankstein, President of The Boulder Group, highlights the importance of escalation clauses in today’s economic environment:

“With interest rates and inflation increasing, those rent escalations are very appealing to buyers, and that is something that is much more important than it was historically because of the current interest rate and inflation environment.”

Apply the Direct Capitalization Formula

Once you’ve determined the net income and selected an appropriate cap rate, you can calculate the value using the direct capitalization formula:

Ground Lease Value = Net Annual Ground Rent / Cap Rate

For instance, if the net annual ground rent income is $125,000 and the cap rate is 4.5%, the ground lease value would be:

$125,000 ÷ 0.045 = $2,777,778.

It’s worth noting that even small changes in the cap rate can significantly impact value. For example, a 50-basis-point increase in the cap rate could lower the value by nearly $278,000.

Be sure to document your cap rate selection process, including comparable transactions, market trends, and property-specific details. This adds credibility to your valuation and helps others understand your approach.

Adjust for Lease Terms and Escalations

Ground lease valuations often require adjustments to account for specific lease features. Escalation clauses and the remaining lease term can influence the valuation. In some cases, a discounted cash flow analysis may be more appropriate to reflect these factors.

Shorter lease terms introduce uncertainty about renewal or reversion value, which might necessitate adjustments to the cap rate. At the end of the lease, the reversionary interest - where the land and any improvements revert to the lessor - should also be factored into the valuation.

Common Mistakes to Avoid

Accurate valuation depends on precise inputs, so it’s important to steer clear of common errors. One frequent mistake is using inappropriate cap rates, such as those derived from fee simple sales, or failing to account for lease-specific factors. Overlooking essential expenses, such as property taxes or maintenance, can also lead to inaccuracies.

Market timing is another critical factor. Cap rates fluctuate with market conditions, and relying on outdated comparables can distort results. With rising interest rates, cap rates may also increase. Keep in mind that cap rates balance expected returns with income growth rates. Properties with strong income growth potential may justify lower cap rates, while those with limited growth prospects might need higher ones.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

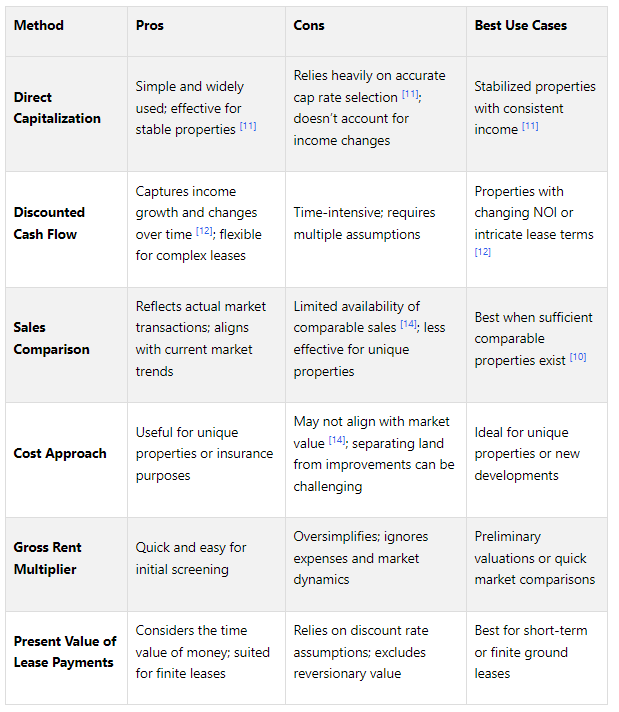

Other Valuation Methods

While direct capitalization is a straightforward approach, other methods can provide additional perspectives on valuation. Each method has its own strengths and limitations, so understanding when and how to use them is crucial. Below is a breakdown of alternative methods to help clarify their best applications.

Alternative Valuation Approaches

Discounted Cash Flow (DCF) Method

The DCF method adjusts annual rental income, vacancy rates, collection figures, and expenses to reflect income growth over time. This approach is particularly helpful for ground leases with complex escalation clauses or fluctuating income streams throughout the lease term.

Sales Comparison Approach

This method estimates value by comparing similar ground lease transactions in the market. However, finding truly comparable sales can be a challenge since ground lease transactions are less common than traditional property sales.

Cost Approach

This method focuses on isolating the value of the land. It calculates value based on the costs associated with operating and maintaining the property. For ground leases, this approach emphasizes the current cost of acquiring the land.

Gross Rent Multiplier (GRM)

GRM is a quick way to estimate value by using the ratio of property price to annual gross rental income. While it’s less detailed than other methods, it can serve as a useful initial benchmark for valuations.

Present Value of Lease Payments

This method calculates the present value of all future lease payments, taking into account the time value of money. It’s especially useful for leases with a defined end date.

Yield Capitalization Method

Unlike direct capitalization, which focuses on a single year’s income, this method accounts for fluctuations in annual income and expenses over time. It provides a more dynamic view of valuation for properties with variable cash flows.

Pros and Cons of Each Method

The choice of valuation method depends heavily on the lease's characteristics and the available data. For properties with a stable net operating income (NOI), direct capitalization is often the go-to method. Meanwhile, DCF is better suited for properties with fluctuating NOI or complex lease structures.

In many cases, investors use multiple valuation methods to cross-check their results. For office, retail, and multifamily properties, the income approach - encompassing both direct capitalization and DCF - is often the most reliable. However, the sales comparison method is highly effective when there is an abundance of comparable properties, though this is a notable limitation in the ground lease market due to the infrequency of such transactions. Accurate and reliable data remains critical to achieving a reliable valuation.

Tools and Expert Support

Expanding on the direct capitalization method mentioned earlier, the combination of advanced financial models and expert guidance plays a key role in refining ground lease valuations. Achieving precise valuations requires more than basic calculations; it demands specialized tools and insights. The right mix of software and professional expertise can transform rough estimates into well-supported valuations that hold up under scrutiny. Below, we’ll explore how advanced financial models and expert services contribute to more accurate ground lease assessments.

Financial Models for Better Analysis

Financial modeling is essential for understanding property performance, managing risks, and calculating returns. However, traditional spreadsheet-based methods often fall short when applied to the intricate cash flow patterns and rent escalation structures typical of ground lease investments. For instance, some basic models treat ground lease payments as operating expenses above net operating income (NOI), which can inaccurately reduce the investment value by applying the ground lease payment to the assumed cap rate. This method lacks precision.

More advanced valuation tools take a different approach. They place ground lease payments below NOI and calculate land value by determining the present value of cash flows using a user-defined discount rate. These tools are better equipped to handle the complexity of ground lease structures, including rent escalation clauses and the premium pricing often associated with such transactions. When selecting a modeling tool, consider factors like ease of use, data requirements, and whether the tool supports real-time data integration and scenario analysis. Modern platforms can even incorporate benchmarks into model calibration, providing a more comprehensive view of valuation outcomes.

While advanced tools are invaluable, expert guidance can further fine-tune these valuations, ensuring they align with market realities.

How The Fractional Analyst Can Help

The Fractional Analyst offers a middle ground between basic tools and high-cost consulting services, providing expert support and a self-service platform at accessible price points. Their custom financial analysis services start at $95 per hour, making professional-grade insights available for projects of varying budgets. One standout offering is the CoreCast system, a collaborative financial modeling platform tailored for commercial real estate. Currently in beta at $50 per user per month (with pricing expected to increase to $105 per user per month post-launch), CoreCast allows teams to work together in real time on complex valuation models.

For those who prefer a more hands-on approach, The Fractional Analyst also provides a library of free, customizable financial models. These include templates for multifamily acquisitions, mixed-use developments, and IRR matrices, all designed to address the specific needs of different property types. Beyond tools, their direct servicing option connects clients with top-tier financial analysts who specialize in commercial real estate. These professionals offer end-to-end support, from strategy formulation to ongoing asset management. Their expertise is particularly valuable for ground lease valuations, where they can identify risks and opportunities that automated tools might miss.

When evaluating or structuring ground leases, rent escalations are a critical factor. The Fractional Analyst team excels at integrating these details into valuation models, ensuring that escalation clauses, market premiums, and risk factors are accurately reflected. This comprehensive approach ensures valuations remain aligned with current market conditions and investor goals.

Conclusion

Using capitalization rates to value ground leases offers investors a dependable and straightforward method for estimating property values. The direct capitalization approach simplifies the process and yields consistent results.

Key Points Summary

Capitalizing ground leases involves converting lease payments into a single present value figure. This method focuses on objective factors like ground rent payments and cap rates, reducing the influence of subjective market interpretations or sudden fluctuations.

Ground lease cap rates are typically much lower than those for traditional real estate investments, often dipping below 3% or falling within the 3% to 6% range.

“The cap rate is important for investors to adapt because it projects an investment’s income, returns, and expenses and helps them better estimate their returns and determine if a project will be feasible.”

The valuation process includes determining annual ground rent income, selecting a market-appropriate cap rate that accounts for risk, and applying the direct capitalization formula. Adjustments for factors like lease terms and escalation clauses ensure valuations align with actual market conditions.

Next Steps for Accurate Valuation

To refine your ground lease valuation efforts, consider these practical steps. Successful investors emphasize thorough research, detailed analysis, and the use of professional tools.

“Investors navigate ground lease rates by conducting market research, evaluating the lease agreement, considering the risks of the investment, and negotiating rates with the landowner. Investors should also seek professional help to ensure the lease agreement is in accordance with local regulations.”

Market research is the foundation of accurate valuations. Study comparable ground lease transactions, review historical data for trends and risks, and assess current market conditions alongside tenant profiles. This information helps in selecting suitable cap rates and making necessary valuation adjustments.

Lease agreement analysis is equally important. Pay close attention to escalation clauses, renewal terms, and termination conditions, as these directly affect cash flow forecasts and risk evaluations.

Leverage professional tools and expertise for more precise outcomes. Advanced platforms like The Fractional Analyst's CoreCast system can model complex cash flows and rent escalation scenarios, far surpassing the capabilities of basic spreadsheets. For more intricate projects, custom financial analysis services provide expert-level insights.

Capitalizing ground rent is a critical step in creating accurate investment pro formas that project income, expenses, and returns. By using cap rates, investors can evaluate properties based on a consistent percentage metric, avoiding decisions driven by volatile market rents or property prices.

Combining systematic methods, in-depth research, and expert tools ensures reliable ground lease valuations. Whether you're assessing a single property or managing a broad portfolio, these strategies are key to navigating the commercial real estate market effectively.

FAQs

-

Interest rates and broader market trends significantly impact capitalization rates for ground leases. When interest rates climb, borrowing becomes more expensive. This often pushes cap rates higher, as investors look for greater returns to compensate for the increased costs and perceived risks. On the flip side, when interest rates drop or remain steady, cap rates tend to decrease, making ground leases more attractive by boosting potential investor returns.

Market trends like economic growth, inflation, and overall investor sentiment also shape cap rates. For example, during times of economic uncertainty or heightened risks, cap rates usually rise to account for the added risk premium. In contrast, when the economy is strong and the market feels stable, cap rates tend to fall, reflecting reduced risk and greater confidence among investors.

Grasping these factors is crucial for accurately assessing the value of ground leases and making smart investment choices in the commercial real estate sector.

-

Investing in ground leases offers a range of advantages, including steady, long-term income, possible tax benefits, and the opportunity to secure prime locations without buying the land outright. These features make them an attractive option for investors looking for stable returns with lower risk.

That said, ground leases aren't without challenges. They can be affected by lease termination clauses, shifts in land value, and financing difficulties, as some lenders view them as less secure than traditional real estate investments. Moreover, these leases often include restrictions that could limit how the property is used or developed.

With careful planning and a thorough review of the terms, ground leases can be a profitable, lower-risk investment. However, understanding the potential risks is essential before diving in.

-

Escalation clauses in ground leases are key to maintaining steady rent growth and aligning with market trends. These clauses typically tie rent increases to inflation or market benchmarks, ensuring the lease's value keeps pace with rising costs. For investors, this kind of built-in adjustment allows for more reliable cash flow projections and helps mitigate risks associated with inflation.

From a valuation perspective, escalation clauses are just as important. They ensure a consistent income growth trajectory, which plays a critical role in determining capitalization rates. This steady growth not only boosts the property's appeal for long-term investment strategies but also strengthens its potential to generate income over time. By including escalation clauses, landlords and investors can better position themselves to achieve financial stability while adapting to market changes.