Replacement Cost in CRE Appraisals

Replacement cost in commercial real estate (CRE) appraisals is the estimated cost to rebuild a property using modern materials and construction methods, excluding land value. This method is key for assessing insurance coverage, valuing specialized properties, and making investment decisions when market data is limited.

Key Points:

Definition: Replacement cost focuses on rebuilding expenses at today's standards, not market trends.

Applications: Used for insurance, tax assessments, and appraising unique properties like schools or historic buildings.

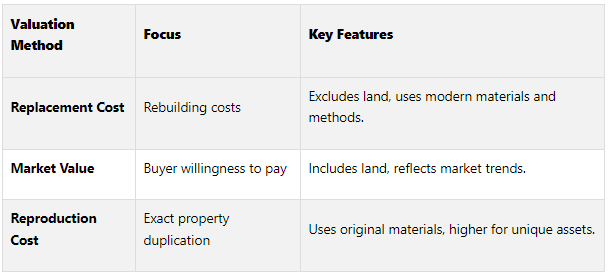

Comparison:

Replacement Cost: Cost to rebuild with modern methods, excludes land value.

Market Value: What buyers are willing to pay, includes land value.

Reproduction Cost: Cost to recreate an exact replica, often higher for unique properties.

Calculation:

Add land value to construction cost.

Subtract depreciation (wear, outdated features).

Data Sources: Tools like RSMeans and custom databases provide updated material and labor costs.

Quick Comparison:

This method is especially useful for new construction, insurance claims, and properties with scarce market data. Regular updates ensure accuracy amid inflation and market shifts.

What is Replacement Cost in CRE Valuation

Replacement Cost Definition

Replacement cost refers to the expense of constructing a similar property at today’s standards, excluding the value of the land. This method takes into account current prices for materials, labor, and construction fees to estimate what it would cost to build a comparable property with the same utility. The idea behind this approach is straightforward: a buyer wouldn’t pay more for a property than it would cost to build a replacement from scratch.

To calculate replacement cost, appraisers break down expenses into components - such as materials, labor, and both direct and indirect costs - and then adjust for depreciation. This adjustment accounts for wear and tear, outdated features, and external factors, ensuring the property’s current condition is accurately reflected.

External influences like inflation, labor shortages, and supply chain disruptions can significantly impact material and labor costs. As a result, keeping replacement cost assessments up to date is crucial. This definition serves as a foundation for comparing it to other valuation methods.

Replacement Cost vs Market Value vs Reproduction Cost

It’s important to understand how replacement cost differs from other valuation approaches.

While replacement cost focuses on construction expenses using modern standards, market value considers what buyers are willing to pay in the current market, including land value and other factors like location and cash flow potential. On the other hand, reproduction cost involves recreating an exact duplicate of the property, typically leading to higher costs - especially for historic or unique structures. The replacement cost approach is particularly useful when comparable market data is scarce, as it doesn’t rely on active market conditions.

When to Use Replacement Cost

Replacement cost becomes especially useful when market data is limited, offering a reliable alternative for valuation.

This method is ideal for unique or specialized properties, such as custom-built facilities, historic buildings, schools, or healthcare centers, where finding comparable sales can be difficult. It’s also well-suited for new construction projects with minimal depreciation, as the replacement cost often aligns closely with the actual investment in construction.

In insurance, replacement cost calculations are critical for determining appropriate coverage levels. Accurate estimates ensure properties are adequately insured, even as construction costs fluctuate. Additionally, this method is often applied in tax assessments, particularly for properties where income or sales comparison methods don’t yield reliable results.

Working with experienced professionals - like contractors and cost estimators - is key to this process. Their expertise ensures accurate assessments of current construction costs and helps identify modern equivalents for outdated building systems.

How to Calculate Replacement Cost

The Cost Approach Method

The cost approach method determines property value by combining the land's worth with the net construction cost (current construction cost minus accumulated depreciation). The idea here is simple: a buyer wouldn't pay more for an existing property than it would cost to build a new one.

Here’s how it works:

Land Value: Appraisers start by evaluating the land's worth, often by examining recent sales of comparable properties.

Construction Cost: Next, they estimate the cost to construct a similar building using current materials and standards.

Depreciation: Finally, they account for depreciation. This includes physical wear and tear, outdated features, or external factors affecting value. Depreciation can be calculated using methods like the age-life method, breakdown method, or market extraction method.

This approach is especially effective for newer properties with minimal depreciation. It’s also useful in scenarios like new construction projects or insurance claims, where direct market comparisons may not be available.

When estimating building costs, appraisers consider both direct costs (materials and labor) and indirect costs (permits, fees, and overhead). Reliable and up-to-date construction cost data is key to making this method work effectively.

Construction Cost Data Sources

Accurate construction cost data is at the heart of reliable replacement cost calculations. For commercial real estate projects, construction cost databases are indispensable for budgeting, cost estimation, and financial planning. These databases provide current information on material, labor, and equipment costs - critical for creating realistic estimates and staying on budget.

Using such databases can be a game-changer. They can cut estimating time in half, allowing teams to double the number of estimates they complete. Without them, teams may waste up to 50% of their time gathering and verifying data.

Professionals often rely on a mix of sources:

Standardized Databases: Tools like RSMeans and Costbook offer generalized pricing information.

Custom Databases: Tailored to specific projects, these provide a more precise picture.

Historical Benchmarks: Past project data and industry insights serve as valuable references.

Technology: Tools like construction estimation software and Building Information Modeling (BIM) enhance accuracy and efficiency.

“The reality is estimating, and preconstruction isn’t just about cost anymore, it’s about how you deliver your information.”

Regular updates to these databases ensure they reflect current market trends and conditions. Using multiple metrics - such as cost per square foot or unit cost benchmarks - further improves the accuracy of estimates.

Expert Input in Cost Estimation

While databases are essential, expert insights bring a level of refinement that automated tools alone can't achieve. This is especially true for complex or custom properties where standardized cost guides might fall short. Professionals like quantity surveyors apply their experience and systematic methods to produce more accurate estimates. Relying solely on generic tools can lead to less reliable results.

Expert appraisers also provide replacement cost data that lenders use to determine appropriate levels of hazard insurance. These professionally developed estimates ensure insurance coverage reflects the actual cost to replace a property, rather than its depreciated value.

“It is not appropriate for the lender simply to subtract the reported site or land value from the appraised value of the property to make that determination because that result is an estimate of the depreciated value of the improvements, not an estimate of their replacement cost.”

What is Replacement Value in Commercial Real Estate?

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

How Replacement Cost Affects CRE Decisions

Replacement cost valuations play a key role in shaping decisions within the commercial real estate (CRE) sector, influencing investment strategies, lending practices, and insurance policies. By grasping these valuations, professionals can make smarter choices and better handle associated risks.

Replacement Cost vs. Market Value Analysis

Understanding the difference between replacement cost and market value is crucial for evaluating property value and market trends. The gap between these two metrics often reveals mismatches between construction costs and buyer expectations, offering valuable insights into property conditions and market dynamics.

As the Appraisal Institute explains:

“...the cost approach is based on the understanding that market participants relate value to cost.”

Replacement cost is also a useful tool for investors when evaluating the financial viability of new construction projects that could compete with existing properties. It helps assess risks such as newer developments attracting tenants away from older buildings. Additionally, it can guide strategies like renovations or lease incentives to ensure existing properties remain competitive.

Risk Management Applications

Replacement cost is a cornerstone of risk management in underwriting and insurance decisions, especially when setting budgets for reconstruction. Insurers rely on replacement cost to determine coverage levels, which directly impacts premiums, risk strategies, and payout amounts. However, challenges can arise if valuations fall below policy thresholds.

“Insurance can become a sticking point in CRE transactions, where owners are no longer able to continue obtaining full replacement cost coverage that’s typically required by lenders, without facing sizable increases in premiums that could hit property cash flows.”

Lenders also depend on accurate replacement cost assessments. Loans typically cover 70% to 90% of a property's value, and properly valued collateral can reduce borrowing costs by around 23 basis points compared to unsecured loans. To avoid complications like coinsurance penalties or insufficient coverage, professionals should ensure replacement cost valuations are updated regularly. For instance, Florida statute 718.11 (11a) requires condominium buildings to reassess their replacement cost at least every 36 months.

“Long before a policy is signed, a detailed conversation between lender, loan applicant, insurance broker and risk modeler can help lenders align their requirements with an asset’s true risk, rather than requiring full replacement cost coverage for every asset irrespective of its risk profile.”

These insights highlight how replacement cost evaluations are integral to managing risks effectively, setting the stage for a broader comparison of valuation methods in CRE.

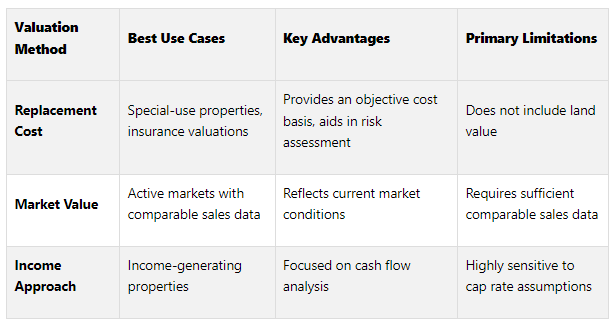

Valuation Method Comparison

Comparing different valuation approaches can clarify the strategic role replacement cost plays within CRE decision-making. Here's a breakdown of the primary methods:

The cost approach is particularly useful for special-use properties or when comparable sales data is scarce. Lenders often rely on replacement cost valuations to confirm adequate insurance coverage, safeguarding both the borrower and the loan. Additionally, replacement cost analysis can guide decisions on property updates to maintain market competitiveness, helping investors navigate the complexities of CRE appraisals.

Real-World Applications and The Fractional Analyst Support

Replacement Cost in CRE Transactions and Management

When it comes to commercial real estate (CRE), understanding replacement costs isn't just a theoretical exercise - it plays a direct role in shaping investment and management strategies. Investors and managers rely on replacement cost analyses to make informed decisions about acquisitions, insurance planning, and competitive positioning.

Take the example of Summit Peak Partners in Boulder, Colorado. They evaluated Alpine Office Plaza, a 100,000-square-foot office property priced at $32 million ($320 per square foot). Their detailed breakdown included hard costs of $240 per square foot, soft costs of $60 per square foot, and land costs of $20 per square foot. The total aligned with the market price, but factors like high occupancy and rising construction costs made the acquisition a smart move.

This type of analysis helps investors avoid overpaying and spot opportunities where buying an existing property makes more sense than developing a new one. It also ensures insurance coverage accurately reflects current rebuild costs, accounting for inflation. Additionally, replacement cost insights guide renovation strategies, helping older properties compete with newer developments. This might involve updating the property or offering lease incentives to retain tenants in a competitive market. Given the complexity of these evaluations, having the right tools and expertise is crucial.

The Fractional Analyst Tools and Services

To tackle these challenges, The Fractional Analyst provides cutting-edge tools and expert support tailored to the real estate industry. Our team of financial analysts specializes in underwriting, asset management, market research, investor reporting, and pitch deck creation. By adopting a fractional model, we offer companies access to top-tier expertise without the expense of full-time hires.

Our pricing is flexible and straightforward. See our fee schedules below.

These professionals, many of whom come from leading firms, are trained across multiple client engagements to ensure high-quality results.

At the heart of their service is CoreCast, a real estate intelligence platform designed to simplify replacement cost analysis. CoreCast offers advanced underwriting tools across asset classes like multifamily, office, industrial, retail, hospitality, self-storage, and medical office. The platform also uses AI-powered document parsing to extract data from uploaded files and provides real-time projections that adjust as assumptions change.

We’re working on a conversational interface that will makes it easy to interact with complex data.

For instance, you could ask:

“CoreCast, I’m underwriting a mixed-use development with 100 multifamily units, 20,000 square feet of retail, and 15,000 square feet of medical office. Can you layer in stabilized assumptions for each use?”

The platform might reply:

“Absolutely. Using historical comps for your market, here’s the projected lease-up schedule, TI assumptions, and exit values for each component. Would you like to run sensitivities by use type?”

The impact of these tools is evident in real-world scenarios. In one case, The Fractional Analyst stepped in to fill a two-year gap in a client’s analyst function, quickly integrating with debt and equity partners to realign their portfolio over eight months. In another instance, a client regained project funding after The Fractional Analyst delivered polished, institutional-grade materials in just a few days. Their lender remarked that the updated documents provided the confidence needed to proceed.

Key Takeaways

Here’s a quick recap of the main points we’ve covered:

Replacement cost represents the expense of rebuilding an asset using current prices, materials, and methods. It plays a critical role in commercial real estate by shaping pricing, investment decisions, and risk management strategies. Understanding how it differs from market value is essential.

Replacement cost vs. market value: While market value reflects what buyers are willing to pay, replacement cost focuses exclusively on construction expenses. This distinction is crucial when deciding whether building new properties is more cost-effective than purchasing existing ones.

Insurance and inflation: Regularly updating replacement cost valuations is vital for proper insurance coverage, especially with inflation rates hitting up to 9% in recent years. Without updates, property owners risk coinsurance penalties, which require coverage at 80%, 90%, or 100% of the replacement value.

The cost approach: This formula - Value = Construction Cost – Depreciation + Land Worth - offers a systematic way to account for depreciation. It’s particularly useful for evaluating special-use properties, new constructions, or recently renovated buildings where comparable sales data might be scarce.

Tools for professionals: Platforms like The Fractional Analyst's CoreCast streamline replacement cost analysis with features like advanced underwriting, AI-powered document parsing, and real-time projections. Beta pricing starts at $50 per user per month.

These insights equip commercial real estate professionals with the knowledge and tools to make informed decisions about property investments, insurance, and valuation strategies.

FAQs

-

The replacement cost method influences both insurance premiums and coverage by calculating the expense of rebuilding or replacing a property with materials of comparable quality at current market prices. This approach often results in higher premiums because it provides full coverage without considering depreciation, ensuring there are sufficient funds to completely restore the property after a loss.

Although this method offers stronger protection, the increased premiums reflect the cost of guaranteeing a full replacement. For commercial property owners, it delivers reassurance but also demands thoughtful financial planning to handle the higher insurance costs effectively.

-

The replacement cost is the estimated expense to rebuild a property using modern materials and construction methods, based on current market prices. On the flip side, the reproduction cost focuses on replicating the property exactly as it was originally built, using the same materials and techniques.

Replacement cost is often used in appraisals for properties with contemporary features or for large-scale valuations, as it provides a practical and updated view of rebuilding costs. In contrast, reproduction cost is typically reserved for insurance purposes or situations requiring an exact replica, such as restoring historic buildings or architecturally distinctive properties where maintaining original details is essential.

-

Keeping replacement cost valuations current is essential in commercial real estate because inflation and shifting market conditions can dramatically alter the cost of materials and labor needed to rebuild a property. If valuations are outdated, they may underestimate reconstruction costs, resulting in appraisals that don’t reflect reality.

By updating valuations regularly, appraisals stay aligned with today’s market conditions. This provides more accurate and dependable data for investors, lenders, and insurers. In fast-changing markets, where costs can fluctuate quickly, staying updated helps stakeholders make smarter decisions and avoid unexpected financial gaps.