Tax Planning for Ground Lease Term Structures

Ground leases, commonly lasting 50–99 years, present unique tax challenges for both landlords and tenants. These agreements allow tenants to develop and use land while paying rent and covering costs like property taxes and maintenance. However, their structure creates specific tax implications:

Landlords: Rental income is taxed, but deductions can offset it. Depreciation on land is not allowed.

Tenants: Lease payments and property-related costs are deductible. Improvements can be depreciated, but proper cost allocation is crucial.

Transfer Taxes: Long-term leases (e.g., over 49 years in New York) may trigger transfer tax liabilities.

Depreciation: Tenants can depreciate improvements but must follow strict rules, especially in sale-leaseback deals.

Gain Recognition: Ground leases can defer gain recognition, but improper structuring may lead to immediate taxation.

Proper planning - such as structuring lease terms to minimize transfer taxes, leveraging depreciation opportunities, and deferring gains through strategies like 1031 exchanges - is essential. Tools like financial models and platforms (e.g., CoreCast) can help navigate these complexities effectively.

What Is A Ground Lease? - Tax and Accounting Coach

Common Tax Problems in Ground Lease Deals

Ground leases come with tax challenges that demand careful planning to avoid unexpected costs.

Property Tax Responsibilities

In most ground lease agreements, tenants are responsible for paying property taxes.

“The tenant must pay the property taxes when the property is subject to a ground lease.”

This arrangement means tenants must account for fluctuating tax payments caused by local assessment changes. To prevent future disputes, the lease agreement should clearly outline these tax obligations. Tenants can challenge high property tax assessments through local appeals, but they must follow the specific rules and deadlines set by their state.

These property tax issues often lead to additional complications, especially around transfer taxes.

Transfer Tax Exposure

Transfer taxes present another layer of complexity, especially in long-term ground leases. Many local governments treat certain ground leases as taxable property transfers, which can trigger transfer tax liabilities.

For example, in New York, ground leases are subject to transfer tax if the lease term exceeds 49 years or includes a purchase option. Considering that most ground leases span 50 to 99 years, this rule impacts nearly all such agreements in the state. Additionally, lease assignments may also result in transfer tax obligations.

In Chicago, Real Property Tax Ruling #5, issued in December 2014, declared that granting tenant rights under a long-term ground lease constitutes the transfer of a taxable "beneficial interest in real property." The city later clarified in January 2020 that this applies even when the lease covers both land and existing buildings. In California, lease assignments must indicate on the front page whether the remaining term exceeds 35 years and ensure the stated consideration reflects fair market value.

These varying local regulations make tax planning for ground leases particularly intricate, emphasizing the need for customized strategies.

Depreciation Limitations

Tax rules prohibit depreciation on land, creating complications in ground lease arrangements where land and improvements are owned separately. Landlords who retain land ownership cannot claim depreciation deductions, limiting their ability to offset rental income.

Tenants, however, can depreciate improvements they add to the property. To do this, they must carefully allocate costs between the land and improvements, keeping detailed documentation to satisfy IRS scrutiny. This is especially critical in sale-leaseback transactions. When significant capital improvements are made, tenants must establish proper depreciation schedules based on the lease's remaining term and the type of improvements.

These depreciation challenges are just one aspect of the broader tax issues tied to ground leases, particularly regarding gain and loss recognition.

Timing of Gain and Loss Recognition

Ground leases offer unique opportunities and challenges for managing the timing of gain and loss recognition, especially in sale-leaseback scenarios. Unlike outright sales, ground leases allow property owners to defer gain recognition, spreading the tax burden over the lease term instead of facing a large capital gain in a single year.

However, the IRS closely examines whether a transaction qualifies as a "true lease" for tax purposes. If deemed a disguised sale, immediate gain recognition may be required, nullifying the intended tax deferral benefits.

Prepaid or deferred rent arrangements add another layer of complexity, as special tax accounting rules may apply. Sale-leaseback transactions, in particular, require careful structuring to avoid double taxation - once on the sale and again on the leaseback.

“We fund proceeds at a premium to the underlying land value, with ground rent at an attractive cost of capital well inside of the cost of permanent financing.”

This example underscores how professional ground lease investors structure deals to achieve both financial and tax efficiency, highlighting the importance of expert guidance in navigating these intricate timing issues.

How Lease Term Length Affects Tax Liabilities

Lease term length plays a crucial role in shaping tax liabilities and transaction costs. Building on earlier discussions about ground lease tax challenges, this section takes a closer look at how lease duration influences tax planning. Below, we explore transfer tax rules, depreciation impacts, and a comparison of tax outcomes based on lease length.

Transfer Tax Rules by Lease Length

Transfer tax obligations vary significantly depending on the lease term, with specific thresholds triggering different treatments in various jurisdictions. States and municipalities often have clear guidelines determining when a ground lease becomes subject to transfer taxes.

In New York, ground leases exceeding 49 years are subject to state transfer taxes. However, New York City applies a different approach: transfer taxes on ground lease creation are 0.40% of the transaction value, compared to 3.025% for outright property sales. Notably, the city bases this tax only on payments made to secure the lease, excluding ongoing rent payments entirely.

California offers another perspective. In the landmark case 731 Market Street Owner LLC v. City and County of San Francisco (June 2020), the California Court of Appeal ruled that purchasing property with a leasehold of 35 years or more remaining does not trigger a documentary transfer tax. This case involved a 45-year CVS lease entered into in 2011. When the property was sold in 2015 with 41 years left on the lease, the court determined that no additional transfer tax was required.

In Washington D.C., leases with terms of 30 years or more, including renewal options, are subject to recordation and transfer taxes. These taxes apply to both rent charges and any additional payments made. If the average annual rent cannot be determined, D.C. calculates the tax based on the greater of 105% of minimum ascertainable rent capitalized at 10% or 150% of the assessed property value.

“Yes, a ground lease of 49 years or less generally does not incur transfer taxes. But transfer taxes shouldn’t guide the decision. There’s a lot more to the discussion.”

Depreciation Rules for Different Lease Terms

The length of a lease also impacts depreciation opportunities for tenant improvements, creating distinct tax advantages based on the duration.

Short-term leases (15 years or less) qualify for special treatment under IRC Section 110 for retail space. Landlords providing cash allowances for tenant improvements in these leases see tenants avoid taxable income if the allowance funds improvements that revert to the landlord at lease termination. Landlords, in turn, depreciate these improvements as nonresidential real property over 39 years.

For mid-term and long-term leases, depreciation rules differ. Tenants who construct and own improvements without landlord reimbursement can depreciate the assets and claim abandonment losses for any remaining tax basis when vacating. Improvements placed in service after January 1, 2018, that qualify as "qualified improvement property" benefit from a 15-year depreciation life and are eligible for bonus depreciation.

The phase-out of bonus depreciation is a critical consideration. Starting in 2023, bonus depreciation dropped to 80%, with a 20% annual reduction until it phases out entirely by 2027. This timeline makes lease term decisions even more important for optimizing depreciation benefits.

For tax-exempt use property, additional restrictions apply. Depreciation must use the greater of the alternative depreciation system life or 125% of the lease term, including pre-negotiated options. This rule often affects leases involving government-owned or tax-exempt properties.

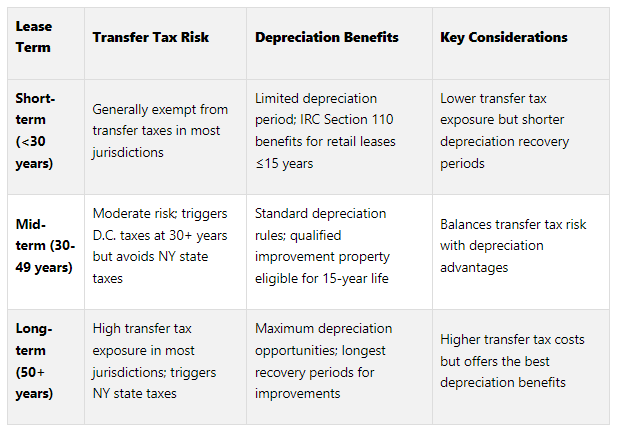

Tax Impact Comparison by Lease Term Length

Lease duration creates distinct tax profiles for landlords and tenants, with varying transfer tax risks and depreciation benefits. The table below outlines these differences:

For example, in New York, a 50-year lease triggers state transfer taxes but provides an additional year of depreciation benefits and greater operational certainty. Meanwhile, in San Francisco, the $30.00 per thousand transfer tax rate for transactions over $25 million makes lease term decisions particularly impactful for high-value deals.

Renewal options further complicate these scenarios, as many jurisdictions count renewal periods when calculating lease terms for transfer tax purposes. For instance, a 40-year lease with two 10-year renewal options is treated as a 60-year lease, potentially triggering transfer taxes that a straight 40-year lease would avoid.

Ultimately, finding the right lease term requires balancing immediate transfer tax costs with long-term depreciation benefits and operational needs. A detailed financial analysis is essential to determine the most tax-efficient structure for each specific transaction.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Tax Optimization Methods for Ground Leases

Strategically managing taxes on ground leases can help reduce liabilities and improve overall returns.

Reducing Transfer Tax Exposure

Minimizing transfer tax exposure often starts with structuring lease terms to stay below tax-triggering thresholds. Since transfer tax rules differ by location, understanding local requirements is a key part of planning.

For instance, in New York, ground leases of 49 years or less can avoid state transfer taxes. However, it’s crucial to account for renewal options, as some jurisdictions include these in the total lease term calculation.

When drafting purchase options, be cautious. In New York, a ground lease that includes a purchase option becomes subject to state transfer tax, regardless of its length. Instead, structuring such clauses as rights of first refusal or limiting their scope can help reduce exposure.

Sale-leaseback transactions also require careful planning to avoid double taxation. Jonathan Stein, Director at Goulston & Storrs, highlights this point:

“With proper planning, it may be possible to avoid paying transfer tax twice, once on the sale and once on the leaseback.”

Additionally, planning for the tax implications of potential lease assignments can help mitigate future liabilities.

Next, let’s look at how ground leases can enhance depreciation benefits.

Maximizing Depreciation Benefits

Ground leases present opportunities to optimize depreciation benefits by strategically allocating value between land and improvements. Unlike traditional ownership, where only a portion of the property can be depreciated, tenants under a ground lease can fully depreciate the improvements.

For example, a $2 million apartment with 80% of its value allocated to improvements provides a $58,181 annual depreciation deduction in traditional ownership. However, under a ground lease structure, the tax benefits can increase by 25%.

Additionally, ground lease rental payments are typically fully deductible for federal taxes. This combination of deductible rent and enhanced depreciation creates a powerful tax-saving strategy.

After exploring depreciation, let’s dive into ways to defer gain recognition.

Deferring Gain Recognition

Ground leases offer several methods to defer taxable gains and delay recognizing capital gains.

One popular method is through Section 1031 like-kind exchanges. The IRS considers long-term leasehold interests lasting 30 years or more as comparable to fee simple ownership, making them eligible for tax deferral under 1031 exchanges. Paul Getty explains:

“A ground lease improvement exchange involves using the proceeds from the sale of a relinquished property to acquire a leasehold interest in a ground lease and to make improvements on that leasehold interest.”

This approach allows investors to sell a property, reinvest the proceeds into a leasehold interest, and use the funds to develop or improve the land - all while deferring capital gains taxes.

If a 1031 exchange isn’t feasible, structuring long-term leases as financing deals can also defer gains. In these cases, the transaction is treated as a loan, with rent payments functioning as principal and interest.

Another option is reinvesting proceeds from property sales into Qualified Opportunity Funds within 180 days. This strategy allows investors to delay taxes until December 31, 2026, or until the investment is sold, whichever comes first.

Estate planning can also play a role in deferral strategies. For example, landowners can transfer income rights or leasehold interests to heirs or trusts without transferring ownership of the land. This reduces estate tax exposure while maintaining family control of the property.

Getting Professional Financial Analysis

Because ground lease tax scenarios can be complex, tailored financial models are essential. These models help quantify the tax impact of various lease structures before finalizing terms. They also complement other tax planning strategies, such as those mentioned above.

The Fractional Analyst team specializes in creating custom models that consider factors like transfer tax thresholds, depreciation schedules, and gain deferral strategies. Platforms like CoreCast provide real-time lease management tools, enabling landlords and tenants to adapt as tax laws change. These tools also support decisions around lease modifications, renewals, and exit strategies.

Additionally, CoreCast offers free financial models, including multifamily acquisition templates and IRR matrices, which integrate tax considerations into investment planning.

Professional analysis becomes especially valuable when multiple strategies intersect - such as structuring a sale-leaseback transaction to avoid double transfer taxes while maximizing depreciation benefits and qualifying for 1031 exchange treatment. These scenarios demand a deeper understanding of tax laws and financial modeling to optimize outcomes effectively.

Using The Fractional Analyst for Ground Lease Tax Planning

Ground lease tax planning can be tricky, requiring detailed financial models to achieve the best tax outcomes. The Fractional Analyst steps in with tools and expertise tailored specifically for commercial real estate professionals dealing with challenges like transfer tax exposure, depreciation limits, and gain deferral.

Custom Financial Modeling and Analysis

The Fractional Analyst's team builds customized financial models to tackle the unique tax hurdles tied to ground lease structures. These models factor in critical elements like transfer tax thresholds, depreciation schedules, and strategies for deferring gains - each of which can shift depending on the lease terms.

Custom models become especially helpful when evaluating different lease scenarios. For example, they can compare the financial impact of structuring a lease to stay below key tax thresholds versus extending terms and facing higher liabilities. By modeling various options, real estate professionals gain the clarity needed to choose lease terms and tax strategies that make the most financial sense for their specific deals.

On top of this, The Fractional Analyst’s CoreCast platform provides ongoing support through real-time lease management.

CoreCast for Real-Time Lease Management

CoreCast is The Fractional Analyst's real estate intelligence platform, designed to assist with tax planning throughout a lease’s lifecycle. It offers real-time alerts for important deadlines, helping users avoid penalties or compliance issues that could impact their tax positions.

The platform also automates lease accounting, ensuring compliance with leasing standards while accurately tracking depreciation and rent expenses. Its reporting features include detailed tax data, allowing landlords and tenants to stay on top of their tax positions as leases evolve. Additionally, CoreCast centralizes data on lease modifications, making it easier to understand their tax implications. During its beta phase, CoreCast is available for $50 per user per month, with pricing expected to rise to $105 per user per month as more features are added.

Free Financial Models for Real Estate Professionals

In addition to its advanced tools, The Fractional Analyst provides free downloadable financial models to help real estate professionals evaluate tax trade-offs. These templates cover scenarios like multifamily acquisitions, mixed-use developments, and IRR matrices, embedding tax considerations directly into investment analyses.

These free models enable professionals to conduct preliminary assessments of how lease terms - ranging from 20 to 100 years - affect depreciation benefits and transfer tax exposure across different jurisdictions. With built-in calculations for common tax scenarios, the templates offer a solid starting point for understanding the basic tax implications of ground lease structures before diving into more tailored analyses.

Key Points for Ground Lease Tax Planning

Summary of Tax Problems and Solutions

Ground lease tax planning comes with its share of challenges. These include navigating tenant-managed property tax obligations, dealing with complex transfer tax exposures (especially in states like New York), and balancing non-depreciable land with depreciable improvements. Timing also plays a critical role in recognizing gains and losses. Addressing these issues requires careful and informed planning.

Strategic structuring offers practical solutions. For instance, landlords can use deductions to offset passive rental income, while tenants benefit from fully deducting lease payments and associated operating costs. Proper structuring can also avoid dual transfer tax liabilities in sale-leaseback transactions.

Choosing the right legal structure - whether it’s a trust, partnership, or corporation - can further reduce tax burdens and improve post-tax returns. Compared to outright land sales, ground leases often provide landowners with more predictable tax outcomes, avoiding significant capital gains tax events.

Next Steps for Expert Support

Given the complexities involved, seeking expert advice is essential. Professional guidance can help you evaluate your property, design a lease structure that aligns with your goals, and understand the tax implications of construction-related controls.

The Fractional Analyst offers a tailored approach to these challenges. Their financial modeling services incorporate transfer tax thresholds, depreciation schedules, and gain deferral strategies to create custom solutions. Their CoreCast platform adds value by providing ongoing lease management support, including real-time alerts for critical deadlines and automated lease accounting compliance.

For those looking to start immediately, they also provide free financial model templates. These templates cover scenarios like multifamily acquisitions, mixed-use developments, and IRR matrices, all with embedded tax considerations. They’re particularly helpful in analyzing how lease terms - spanning 35 to 99 years - impact depreciation benefits and transfer tax exposure across different jurisdictions.

Whether you need quick insights through templates or a more detailed custom analysis for complex deals, professional support ensures your ground lease is structured to maximize tax efficiency while minimizing compliance risks.

FAQs

-

Tenants can manage the depreciation of leasehold improvements in a ground lease effectively by taking these steps:

Create a detailed depreciation schedule: Collaborate with a financial professional or quantity surveyor to develop a schedule outlining all capital works and assets eligible for depreciation. This ensures clarity and accuracy in cost allocation.

Handle leasehold improvements as assets: Record these improvements as assets and spread their costs over the shorter period between their useful life and the lease term.

By planning carefully and maintaining thorough documentation, tenants can optimize tax benefits while adhering to IRS regulations.

-

Landlords and tenants can find ways to lower transfer tax liabilities in long-term ground leases by structuring the lease with care. For example, if the lease is set up to qualify as a conveyance under certain tax rules, it might result in reduced transfer taxes compared to selling the property outright.

Another smart approach is using 1031 exchanges, which allow capital gains taxes to be deferred when swapping like-kind properties. To take advantage of this, the lease generally needs to have a term of at least 30 years and meet the IRS's specific criteria.

Careful planning is key here. Working with seasoned professionals or services like The Fractional Analyst can help you navigate the process, stay compliant, and make the most of these strategies.

-

The duration of a ground lease significantly impacts the tax responsibilities and benefits for both landlords and tenants. Long-term leases, generally those lasting more than 30 years, often provide tenants with the opportunity to fully depreciate improvements made to the property over time. Additionally, tenants can usually deduct lease payments as business expenses, which can lower their taxable income. Landlords, on the other hand, may benefit by deferring taxes on rental income and might qualify for options like 1031 exchanges, which can treat long-term leaseholds similarly to property ownership for tax purposes.

In contrast, short-term leases can limit these tax advantages. Tenants may face challenges in claiming depreciation or deductions, and landlords might be required to recognize rental income for tax purposes much sooner. Carefully considering the tax effects of lease length is crucial when structuring agreements to achieve the best financial outcomes for both parties.